Budgeting Basics: How to set-up a budget

You didn't think I wouldn't write about budgets, did you? How could I not? Budgeting has been a constant point of contention in my life since I got my first job and is usually at the top of every person's list of "do I really have to do this" points.

Well, I have good news for you! Creating and sticking to a budget is a lot easier than you think, especially when you take the time to customize it to your personal situation.

Sure, budgets mean tracking your spending, spreadsheets, math. But they also represent an opportunity for you to see your financial growth, to put money aside for life experiences and to get a better view of your spending habits.

Let's jump right in!

Setting up your foundation

I would like to start by saying this: your budget does not need to be some fancy spreadsheet with formulas and color coding and categories, etc. It should only be as detailed as you need it to be, which means that you can show as much information as you believe necessary to get a view of your finances.

In today's post, we're only going to go over setting up a basic, foundational budget and will expand upon this in future posts.

In today's post, we're only going to go over setting up a basic, foundational budget and will expand upon this in future posts.

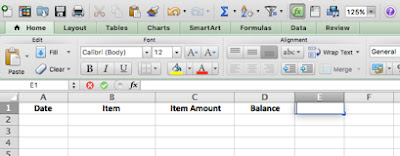

First of all, start by setting up a basic spreadsheet in Excel or Google Sheets. I normally name the first row as the headers for the columns. To keep it easy, let's go with "Date" "Item" "Item Amount" and "Balance."

Next, it's time to start inserting your data. I would suggest doing a monthly budget, going through your monthly input and output amounts. These are the two main items that I usually start with:

- Income

- You should start by listing out any income that you receive. This is going to be your paycheck(s) or any money you receive from working.

- If you would like to go into more detail, you can also include here any money that you make from things like selling items on eBay, ad revenue from a website or social media, etc.

- Repetitive expenditures

- This is going to include any monthly or repeating bills that you pay. For example: rent, utilities, loan payments, phone bill, internet/cable bill, health insurance (if not included in your paycheck), etc.

- As these are normally fixed amounts every month, or very near so, they are easy to track in the long-term and can help you get a wider view of your finances more easily.

- Make sure to insert these with a negative sign to let you that this is an expenditure.

What does this look like for one month? Let's say your rent is the first of every month, your utilities come in the first week of the month, you have one loan payment and you get paid every two weeks:

|

| Figures and dates are examples, used as reference. |

Not too difficult, right? Just by looking at this, you can calculate your discretionary income to determine how much you have left over from these items alone to pay for things like food, transportation, drinks with your friends, entertainment, etc.

Getting fancy with basic formulas

If you don't like doing mental math or having to use the sum function every time you add something into your budget, you can create a handy function in the "Balance" section to calculate all of this for you.

Start by finding the current balance of your bank account. If you're creating a budget template, you can use 0 and the formula will still work.

In the cell D2 (selected in the image above), type the following formula without quotation marks: "C2+###" where ### is the current balance of your bank account, or 0.

Now, in cell D3, enter this formula without quotation marks: "$D2+$C3". Once this is done and you hit enter, a new number will appear. This is your new balance, taking into account your first paycheck, current bank balance and rent payment.

Simply drag the formula down as many cells in column D as you have and it will copy this formula to all of those cells. The final cell (D7 in this case) will be your final balance, taking into account all items.

Alternatively, you can just add the "SUM" function to cell C8: "=SUM(C2:C7)". This will just add up everything in column C.

Final Notes

Budgets can be time-consuming, but they are vital to young people as we start to make more money and pay bills. It's easy to ignore the numbers; as they say, "ignorance is bliss." However, this mindset can lead you into debt and poor decision-making. Take a moment to set up a simple budget and go from there! You never know, you could end up liking it.

This is the first in a series exploring the world of budgeting, so keep an eye out for more tips!

As always, please reach out via comment or Twitter in case you have any questions.

Thank you!

Important Terms

- discretionary income - the amount of money left after expenses have been factored in. Basically, this is your "free" money to use for spending outside of your necessities: food, rent, utilities, bills, etc.

Post a Comment